Our company FinMV is one of those who sell shovels during the gold rush. Now such a "gold rush" is fintech, as well as everything connected with it. As a software developer, it is beneficial for us to launch more and more new and successful platforms for crowdfunding, crowdinvesting, banking, real estate investment, various crypto exchanges and NFT marketplaces. Even very large players in this market use ready-made software and platforms, rather than their own developments.

Every founder who abandoned his dream of launching his own fintech is an "evil" for us, or rather a lost profit. We started last year and hundreds of leads have already passed through us. We have seen many inspired project founders who dreamed, planned, but never launched their project.

Our team is relatively small and we were physically unable to support all projects. Therefore, we turned down all clients who did not have enough money to start. But every time the thought never left me: "What if now there was a founder whom we refused, and then he will launch his future cool project on the scale of PayPal, Revolut, N26, PaySend or Mintos?"

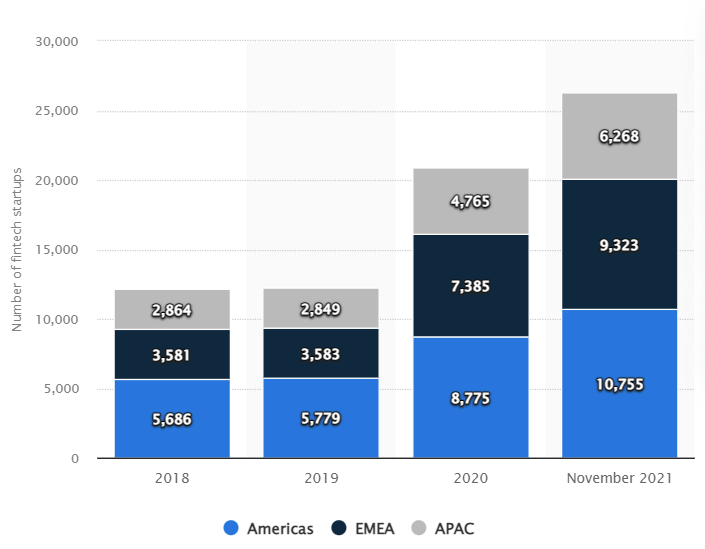

Number of fintech startups worldwide from 2018 to November 2021

Regions: Americas - North and South America; EMEA - Europe, Middle East, Africa; APAC - Asia Pacific

Source: https://www.statista.com/statistics/893954/number-fintech-startups-by-region/

I conducted a study, and found that out of hundreds of leads who did not become our clients, after six months, no one had launched their project in production. What happened? After all, everyone wanted, everyone believed in their idea, but there is really nothing to see.

If 9 out of 10 businesses die in the first year, then at best, only one idea in a million becomes a real attempt to start a business. All other projects die before they even start. How many great ideas did you have that you never got to try? There is no money, there is no team, there is no product, everyone messes up, the IT team is pulling everything from the start, months pass and now nothing is needed...

Other ideas come, followed by new ones, and so it’s good for life if at least one or two can be tried to be implemented. This is all insanely unfair.

Let's go back and talk about the person closest to you - about you. Let's say you want to launch some kind of fintech startup. Well, for example, an NFT marketplace. Now it's popular.

If you chat with other founders, you will most likely hear advice that you should make a landing page and send traffic there to test your business hypothesis. And this is most often correct.

Here are just Google ads and advertising on social networks in many areas are prohibited (including cryptocurrencies and NFTs). You can reach out to communities, invite people to your business card site, and collect leads. But what will you learn? You will only know if your advertising promise is working or not, and you will also calculate the CAC (Customer Acquisition Cost).

It's all great when it's you who makes the promotional promises, but will community owners and influencers back you up? Why should they drive traffic to the landing page? Just to test a hypothesis?

And besides, what to do with the leads from this landing page? Write to everyone that thank you, your call is important to us, is everyone free? I don't know about you, but in my opinion, this is toxic to the market and tactless to interested people. People will waste their time once, twice on such pseudo-proposals, and the third time they will already ignore it. For example, I often see that the site is just a form of capturing personal data or made for free on some kind of site builder (the logo is visible). Personally, I immediately leave such sites and consider this practice of testing business hypotheses to be detrimental.

"Better to aim at perfection and miss than to aim at imperfection and hit."Henry Fowler Watson

No need for half measures. In my opinion, it is better to start, invest some time, understand the market. If the “horse is dead”, then immediately close the project and move on to the next one. But if suddenly the project got into a wave, then you need to immediately be ready to row quickly, because. the wave will not last forever, and the window of opportunity will close sooner or later.

Having made a landing, the founder of the project will not encounter the market and consumers. People are not stupid, they see when a site is a "dummy".

Another thing is if the founder makes a finished product, albeit without expensive integrations, and then fully tests it on the market.

Such a decision is not ashamed to show the world. In this case, the founder is not just the owner of the landing page. He is the owner and CEO of his project. Be it a crowdfunding platform, an online bank or an NFT marketplace.

In this project, full-fledged client cabinets, back office, technical support, security measures, visually everything is like in large companies. So what if the project is not a full-fledged business yet. But it is precisely for business that a founder can attract pre-seed and seed investments. It is not a shame to show such a project to potential clients and investors.

Unlike a landing page, a demo project is not a fake. It is real, it is able to integrate with other service providers. People can register, view agreements and documentation, choose from your projects and products.

Engagement statistics are immediately accumulated, more metrics appear. It’s not just the robots that clicked “Buy” on the landing page that are taken into account. The founder sees lists of real users who have provided all the information about themselves and have passed the KYC procedure. The founders of a startup know every person, they can talk with them not about abstract concepts, but about concrete exposed projects, which are now just in the process of being prepared for sale.

It's like the film industry. Which movie would interest you the most? The one you've only seen on the poster or the trailer you've seen?

Also in business. A landing page is just a poster with a brief description and an incomprehensible picture. Your platform, albeit in demo mode, is a trailer. Clients and investors see what they will get and how it will look. This is an MVP in fintech, not a landing page.

The problem is IT. There are not enough specialists, programmers do it for a long time and expensively.

Ready-made SaaS services know that 9 out of 10 startups fail in their first year. Therefore, they want to earn money immediately. Investing in you is not their business.

Many say that you need to find an investor for the pre-seed stage. The first thing he asks is, where is the team? CTO, development, everything turns into a nightmare and drags on. It's very hard to see when teams have been doing something for years, but they never go into production. And now the second team makes the same project for another year, and again they do not go into production. Most likely, the feelings of the founder and developers of such projects are very different.

Any real business is inert. Coordination of contracts, terms of reference, endless rallies and phone calls, and now six months have passed. And no one has really started to do the project yet.

Life is one, the number of days in it is limited. It is wrong to spend months and years on endless agreements and rallies. But there are other extremes when they want to launch a fintech platform in a day or two or a week. All this comes from a lack of practical experience in IT.

Everything is simple. If you want to launch your startup, your technical competencies are not closed, you have initial resources, but they are not enough, then you need a technical angel.

Our team decided to specialize as a technical angel in fintech in Western countries, so we will only talk about financial platforms (crowdfunding, banking, investing, lending). Such platforms are complex and expensive solutions. Not every founder of a financial platform at the initial stage can afford them, but they also cannot do without them.

We have simplified the approach to the launch. We take our boxed solution. We remove everything that is not needed for the client's project, change the titles and texts, rename the buttons and data columns, and leave the standard design. All this is put on the client's domain address. If necessary, we do integration with KYC (know your customer) and TFA (two-factor authentication) service providers. We dress some template design from the design catalog on the client's website itself. It takes about a month.

In this case, we make our angel investments with an IT solution, not with money.

The size of such investments can reach up to 80% of the setup fee and monthly fee (for the first year). What are we asking for in return? And for this we have formulas that allow you to choose one of the options. We perfectly understand the difficulties of founders and our goal is to support, not interfere.

At such a kind of pre-seed round, if the project “takes off”, then usually in return we claim a loan repayment with a coefficient or a small share of the project.